Rare coins and Classic Cars maintained their status as the world’s top-performing luxury assets in 2015 due to excellent auction results, according to Knight Franks a new report.

The Knight Frank Luxury Investment Index (KFLII), which tracks the performance of selected collectable assets using existing third-party indexes, say the value of the world’s most collectible vehicles increased 17 percent on-year.

“Eight of the 25 cars ever to have sold for over $10 million at auction all went under the hammer in 2015. These included all-time high results for Porsche ($10.1 million) and McLaren ($13.75 million),” Knight Frank said. Jaguar’s C-Type Works Lightweight, sold in August, commanded $13.2 million.

Investors need to keep an eye out for issues ahead. Growth in 2015 was lower than the previous year’s 25 percent expansion.

“The collector market is reacting to a downturn in global liquidity and potential interest rate rises,” citing research firm Historic Automobile Group International (HAGI). HAGI publishes an index on rare collector’s automobiles that Knight Frank used for its KFLII.

Rare coins meanwhile recorded a 13 percent rise last year, higher than 2014’s 10 percent expansion.

The value of rare coins exchanging hands in the U.S. alone was worth between $4-5 billion last year, estimated Stanley Gibbons Investment (SGI), the firm behind the Stanley Gibbons 200 Index that Knight Frank referenced.

Investment-grade coins typically boast the potential to appreciate in value irrespective of what’s happening in financial or precious metal markets, SGI explains on its website.

Among the notable items sold last year was a 2,000-year old gold Aureus coin that went for £300,000 ($433,185).

Just earlier this month, a penny coin dating back to 1933—one of only four ever made—was sold for £72,000 ($103,951), the world record amount for a copper or bronze coin ever sold at auction.

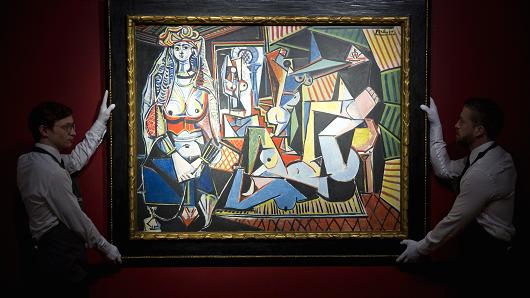

Watches and wine were the next best assets, with a 5 percent spike each, and a 4 percent rise each for jewellery and art.

Both contemporary and modern art produced gains in the latter group, with major sales such as Pablo Picasso’s Women of Algiers setting an all-time auction high of $179 million in May.

Wine is beginning to see a recovery, as fine Bordeaux models start stabilizing following a slump due to dropping Chinese demand.

Chinese ceramics and colored diamonds posted zero growth for the year while antique furniture registered the worst performances on the KFLII, falling 6 percent.

Overall, the KFLII expanded 7 percent in 2015 following last year’s 6 percent growth. In comparison, the FTSE 100 equity index fell 5 percent while the top end of London’s residential property market grew only 1 percent.